social security tax limit

Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits. This amount is also commonly referred to as the taxable maximum.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

The wage base limit is the maximum wage thats subject to the tax for that year.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

. What is the Social Security tax rate. This is the maximum amount of Social Security tax an employee will have withheld from their paycheck. The 2021 tax limit is 5100 more than the 2020 taxable maximum.

Wage Base Limits. Listed below are the maximum taxable earnings for Social Security by year from 1937 to the present. What Is the Social.

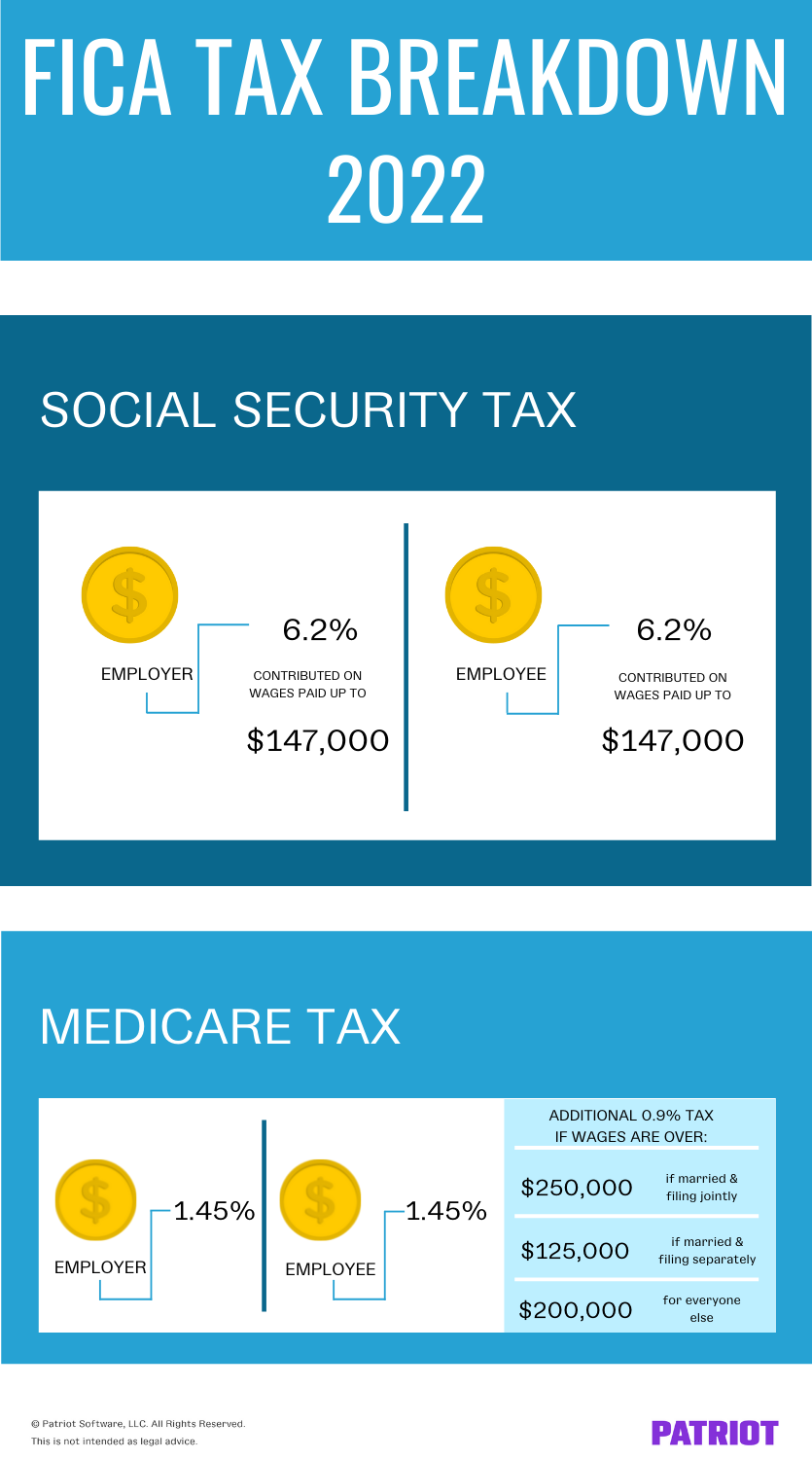

In 2022 the Social Security tax limit is 147000 up from 142800 in 2021. Worksheet to Determine if Benefits May Be Taxable. However your combined income is computed as only 28000 other income plus half of your Social Security benefits.

Half this tax is paid by. For earnings in 2022. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived. Only the social security tax has a wage base limit. Thus the most an individual employee can pay this year is.

Calculating Your Social Security Income. The Social Security tax limit. B One-half of amount on line A.

Read More at AARP. For earnings in 2022 this base is 147000. Social Security taxes in 2022 are 62 percent of gross wages up to 147000.

The limit for joint filers is 32000. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. In 2011 payroll taxes apply to the first.

A Amount of Social Security or Railroad Retirement Benefits. Between 25000 and 34000 you may have to pay income tax on. Year Maximum Taxable Earnings 1937-1950 3000 1951-1954 3600 1955-1958.

9 rows This amount is known as the maximum taxable earnings and changes each year. If you are married filing separately you will likely have to pay taxes on your Social Security income. Since its inception Social Security has featured a taxable maximum or tax max.

In 1937 payroll taxes applied to the first 3000 in earnings. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages.

The Social Security Income limit is 18960 for those who are under the full retirement age. The Social Security taxable maximum is 142800 in 2021. Thats within the 2500034000 range for 50 of.

The OASDI tax rate for. Employeeemployer each Self-employed Can be offset by income tax provisions. The exact amount you must earn each year in order to get the maximum Social Security benefit is called the wage base limit and it varies by year.

We call this annual limit the contribution and benefit base. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800.

Information for people who receive. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits. The earnings limit is called the Social Security Wage Base and it typically goes up every year.

Workers pay a 62. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income. In 2022 youd need an.

The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. Fifty percent of a taxpayers benefits may be taxable if they are. In the year a person is due to reach full retirement age a new income limit of.

The limit changes year to year depending on the national average wage. The annual rise began in 1972 when the wage base was 9000.

2022 Federal Payroll Tax Rates Abacus Payroll

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

Fica Tax Guide 2021 Payroll Tax Rates Definition Smartasset

What Is The Social Security Tax Limit Social Security Us News

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Taxation Of Social Security Benefits Mn House Research

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Is Social Security Tax Calculations Reporting More

Social Security Wage Base Increases To 142 800 For 2021

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age